Introduction –

In the event that you’re hoping to begin tolerating credit card payments from your clients, you’ll have to open a merchant account. While the cycle might feel overpowering from the get go, it’s most certainly feasible. The first and the foremost thing is to get a business permit. To open a merchant account, you’ll need to demonstrate your business is real. The absolute initial step is to get a legitimate business permit. Also, you can understand more on the concept of how to start a payment processing company, here in this article. When you have a business permit, you’ll require a business bank account. This bank account is where your merchant account provider will store your credit card sales and pull out any charges.

Assess to Your Needs –

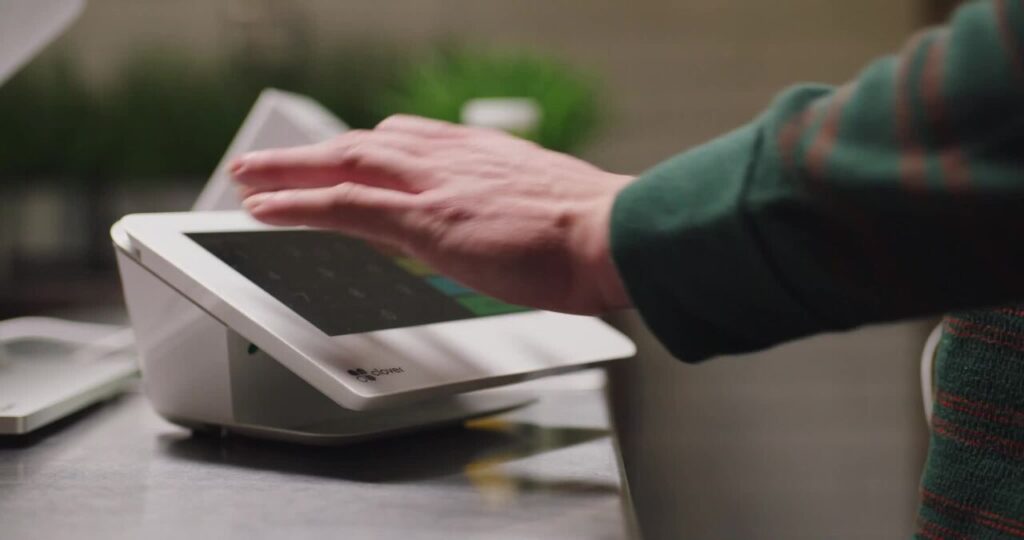

Most businesses like to start a business bank account with a nearby bank, as neighbourhood banks will generally give a degree of comfort and client support that can’t be matched by online accounts. To get everything rolling with a business bank account, you’ll have to give your EIN (manager recognizable proof number) and your business permit. Before you can open a merchant account, contemplate your business needs. For instance, you’ll have to conclude which credit cards you need to process. Will you acknowledge American Express, or just Mastercard and Visa? And ACH or e-Checks? Then, you’ll have to consider how you need to acknowledge credit card payments. Do you basically require an in-person answer for processing payments in your physical store? Or on the other hand do you want an answer that upholds portable payments and online payments? How might your clients pay you — will you give a client payment entry where clients can take care of solicitations?

See Also: The top benefits of a back to base security system for your property.

Evaluate the Providers –

Map out precisely exact thing your business will require, including both the present moment and the long haul. Assuming that you’re anticipating extending in the following couple of years and expect extra payment needs from here on out, make certain to remember them for your preparation. Since you have a thought of what your business needs, you can take that data and begin surveying merchant account providers for the best fit. PCI consistence and solid security is another thing. Merchants have an obligation to safeguard their clients’ credit card data, and that obligation can some of the time feel like a weight. In any case, you can deliver a portion of that pressure by picking a PCI consistent merchant account provider that offers solid security highlights. Realizing your merchant account provider is effectively safeguarding your clients’ weak information will take off a portion of the tension and give you genuine serenity.

Free In-house Support & Financing and Evaluation –

Assuming something turns out badly with your credit card processing, it’s serious stuff — that is your benefit in question. Hope to open a merchant account with a provider that upholds you with all day, every day, in-house client care for nothing. Some merchant account providers offer following day financing choices, so you get cash in your account quicker. Credit card processing expenses are confounding, particularly for merchants just now getting some traction. In the event that your merchant account provider is hazy or anything short of totally straightforward, it very well may be an indication to reevaluate. Research credit card estimating models to see which model is ideal for your business, then, at that point, pick a provider that offers your favoured technique. Two of the most famous and financially savvy evaluating models are level rate and trade in addition to.

Adaptability, Agreements & Charges –

Remember the future while opening a merchant account. Your business might be little or situated in physical now, yet assuming you have plans to extend or wander on the web, you’ll require a merchant account provider that can scale with your developing processing volume and evolving needs. Guarantee your merchant account provider doesn’t need an agreement or pick one that offers month-to-month contracts. The last thing you need is to get gotten into a long agreement with a provider that ends up being a terrible fit. At last, research any charges that will be remembered for your merchant account administration. A few expenses are superfluous and just hurt the merchant. Request an itemized rundown of every included charge, and post for client care expenses, clump expenses, yearly charges, and month to month least charges.

And in the realm of electronic payment solutions, the ISO Agent Program emerges as a catalyst for success. Equipped with expertise in merchant services, card processing, and fraud prevention, ISO agents spearhead the financial technology revolution. With comprehensive training and support, they navigate complexities, forging a path to a cashless, interconnected world.